(VOVworld)- UK voters have chosen to leave the European Union in a historic referendum on Thursday with a narrow win for pro-Brexit campaigners. Regional and global financial markets have seen strong fluctuations. The leave votes may lead to unpredicted consequences that analysts say reshape Europe in the near future.

|

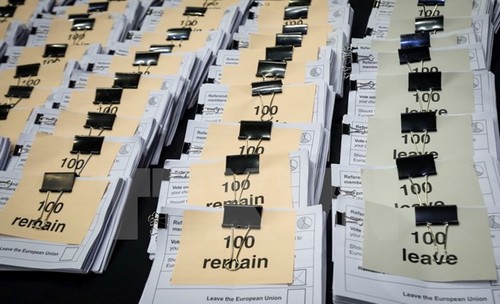

| Counted votes in Manchester, the UK, on June 24 (Photo: EPA/VNA) |

According to final referendum results on Friday, leave won by 51.89% to 48.11%. Nigel Farage, leader of the UK Independence Party (UKIP) who has campaigned for Britain to leave the EU, described the June 24th as "independence day".

Immediate impacts

Financial institutions, major manufacturers, and the global financial market fluctuated after the vote results were announced. Asia’s key stock indexes: the Nikkei of Japan, the Shanghai Composite of China and the Hang Seng of Hong Kong dropped drastically. The Pound Sterling fell by 8.3% to the lowest level since 1985. The Euro plummeted from the 6-week record high.

Many said Brexit may drive the British economy to recession and may create a bad precedence for members of the United Kingdom like Scotland and Wales who intend to leave the UK. Brexit will also push the EU into uncertainties, because the EU will lose an important member who had a stronger say in the group’ decision making. The EU is facing the risk of collapse due to the ripple effect of Brexit.

Brexit, win or lose?

Analysts project that the UK may lose a stable market of 500 million consumers and suffer a loss of 6% in its GDP by 2020 because more than half of British goods are exported to EU countries, contributing 4-5% to the GDP. The banking sector which makes up 8% of British GDP will also be affected. Experts said international banks like the Bank of America, Morgan Stanley or Citigroup will move from the UK to an EU country to be connected with a vast market. Rolls-Royce group warned early this week Brexit will threaten the operation of its engine testing factory in Germany, fearing of losing its competitive edge to American rivals. Multinational companies based in the UK are worried about their shrinking markets.

Economists predict that the Pound Sterling will fall by 15% within one year, shaking the UK’s position as a global financial center.

In addition to its economic effects, Brexit may cause social instability in the UK. More than 2.2 million Britons living and working in EU countries are at risk of being unemployed and removed from social benefits.

The Leave result is not surprising because during the 4-month campaign by both sides, a Brexit scenario had been expected. Britons made their own choice despite the EU’s concession giving the UK “special status” and UK, EU leaders and economists’ projection of a gloomy picture if Brexit happened. Anti-Brexit campaigners said the UK could only be more powerful, safer and more prosperous in a reformed EU.

The decision will not only adversely affect the UK’s economy but also its politics. Analysts say the UK will enter a new period of uncertainty, while the EU made a step backward in its efforts to build a strong bloc since World War II.