(VOVworld) – The price of crude oil on the global market has hit a five-year low at around 60 USD per barrel. The oil price reduction is creating impacts on the global economy as well as potential risks.

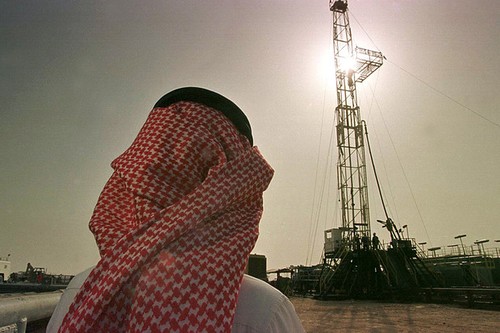

An official of the Saudi oil company at a rig near Howta, Saudi Arabia.

Photographer: John Moore/AP Photo

|

Oil and gas are essential commodities and their prices have a big impact on both suppliers and importers. Oil prices have dropped drastically recently after standing at around 100 USD per barrel for 4 years.

Reasons

Oil prices have plunged since the OPEC meeting in Vienna on November 28. OPEC decided to maintain its production despite proposals from some members to reduce production to prevent a slide in prices.

Abundant supplies and a decline in global demand have greatly impacted crude oil prices. Other reasons are the US’ increasing oil production and strong competition from natural gas as an alternative.

OPEC Secretary General Abdalla Salem el-Badri said just a small increase in supply could not cause to a sharp drop in prices, adding that he believes speculation has played a strong role in creating these prices.

One cries, one smiles

Economically, oil and gas importers like China, Japan, the Republic of Korea, and the US are the biggest beneficiaries. Falling oil prices have boosted the global economy 0.5%.

The long price decline has hurt many exporters. The IMF has calculated that Russia is the most affected country because petroleum accounts for 80% of its export revenue and contributes 50% of the state budget. Russia loses 2 billion USD for every one dollar drop in the oil price. Since the oil price slump, Russia’s state budget has lost over 100 billion USD. The Russian ruble dropped to its lowest value ever when one USD equaled 60.49 Rusian rubles on Monday.

The International Monetary Fund in October calculated the oil price different governments need to balance their budgets. Iran needs a price of 136 USD, Venezuela and Nigeria 120 USD, and Russia can manage at 101 USD a barrel.

The oil price decline has made investors and oil companies hesitate to invest in new oil fields. In the US, oil companies have shut down 29 drilling platforms, the most in the past 2 years.

The US stock market has seen declining sessions due to the oil price plunge of the last 2 weeks. The Dow Jones index of 30 big enterprises lost 204 points, equivalent to 1.2%, to 17,391. Since the beginning of this month, the Standard & Poor 500 index dropped 4.9%. The EU’s major securities indexes have also been affected.

Oil price prediction

The International Energy Agency has issued a gloomy prediction. The IEA predicts that global oil consumption in 2015 will drop between 230,000 and 900,000 barrel per day. OPEC says next year’s oil demand will be 28.15 million barrels per day.

Experts predict that if OPEC doesn’t intervene promptly and reduce production, oil prices could drop to 55, 50, or even 40 USD per barrel. But OPEC said at an emergency meeting on December 15 that it will not reduce production.

The Vietnamese government has increased its crude oil stockpile and adjusted its exploitation plans in response to the plunge in oil prices.